Matthew Gawn

Matthew Gawn

The UK Waste Industry Software Technology Review & Alignment Research

Phase 3 – The Report

In Spring 2022 the Chartered Institute of Wastes Management (CIWM) and ISB Global launched a research project to better understand the perception and use of software in the UK waste industry.

The project started with an extensive questionnaire, and results presented to a focus group to gather further insights. This initial analysis was then presented in a webinar to a separate sample audience to check on answers, help alleviate bias and ensure impartiality.

Phase 3 of this project is now underway and will see the information collated from the first two phases used to produce a report detailing the results of the research.

What have we learned?

There have been some very interesting findings to date, so we wanted to share some of the details ahead of publishing the full report.

This will help to give the extended waste and recycling community and initial understanding both of the results and the potential they deliver for the advance of digital transformation across the industry in the UK.

Applications, data and productivity

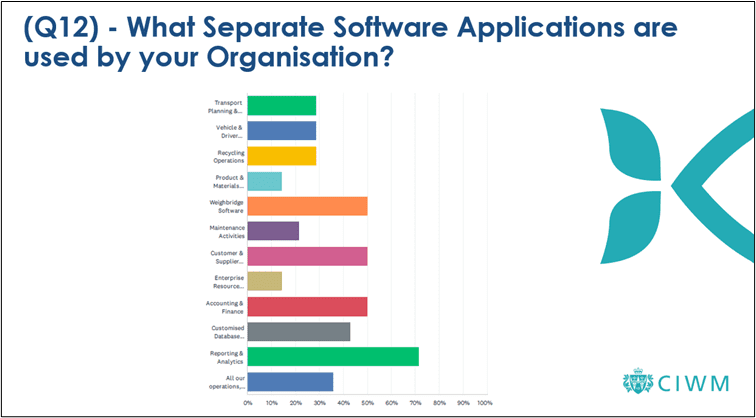

Anecdotally, the team at ISB Global was aware that waste and recycling management companies are using several different software applications to run their businesses.

Part of our research activity was to collect data in this area, and the results were interesting. We asked participants about the applications they used, the way they gathered and reported data, and the manual interventions they were still making.

We found that of our sample – gathered from the questionnaire and then re-checked in a different sample during the webinar – 67% of the sample used between five and 12+ software applications.

We also asked about manual intervention and manual data entry, and found that 69% of respondents said that more than 25% of their day-to-day transactions are still conducted manually.

We were interested to know whether our sample audience used waste-specific software solutions, or had chosen generic applications. Responses showed that over 25% do not use specialist waste management software and have chosen generic software applications. We also discovered that many still use spreadsheets to plug any data gaps.

In the Phase 2 webinar, we rephrased the question and asked: ‘How much development work is generally anticipated when purchasing, installing and using software?’ 71% of respondents said that when implementing waste management software, over 40% of the work is additional development to make the software fit with their operation.

Insight and conclusion

Even from this small section of our research, it’s clear to see that waste and recycling companies are using many different generic software applications, whilst also relying on spreadsheets and manual transactions for some processes.

This leads us to believe that most specific waste management software is either not built to meet the needs of organisations, or that organisations don’t consider this type of software when they are investing or upgrading.

These statements support one of the hypotheses first drafted before the research commenced:

“There is some way to go for the UK sector to digitally transform and embrace integrated and emerging software technologies.”

Is this overarching hypothesis now backed up by this supporting research and insight into the perception and use in the industry? We think more in-depth, qualitative research is required.

Another result from the samples shows that suppliers and vendors need to work more closely with the industry to drive the productivity that digital transformation and subsequently circularity can deliver.

What opportunities can we identify?

In this article, we want to highlight one opportunity – tackling the productivity lost to time-consuming manual interventions throughout business processes.

69% of our respondents told us that more than 25% of their transactions were manual. The UK has approximately 150,000 employees in the waste sector. Approximately one-third of these staff will complete most of their working day in the back or front office, and roles associated with managing digital processes.

Assuming each of these staff work an 8-hour day, two hours would be spent on manual transactions. That equates to 70,000 hours per day spent on manual transactions UK-wide. Multiplied by 260 working days annually results in 18.2 million hours a year spent on manual transactions. Multiply that by the minimum wage for those over 23: £10.42 per hour. The result is £189.6m spent on manual transactions annually in the UK waste and recycling sector.

And this is just the ‘wage cost’. When people are spending 25% or more of their time on manual transactions, productivity reduces and organisations are less efficient. And with regulation increasing, customers demanding wider services and the drive towards a circular economy, waste and recycling businesses need to transform the way they manage all their business processes.

There are numerous other value engineering examples to quote in the order to cash or purchase to pay process.

Compelling reasons for change

If we think about how this works with just one company with 100 key business processes and a 1,000 transactions per day, it’s easy to see how inefficiencies can accumulate. Add the lack of speed, accuracy, reporting and intelligence to time factor and the size of the problem becomes much greater.

The situation could be further exacerbated by not being able to add new technologies because the business feels the data in the manual transaction cannot be trusted to be automated. Ultimately this results in poor quality, sector-wide data at a time when good trustworthy data is desperately needed.

What could we achieve?

Imagine a UK waste and recycling sector where the majority of organisations have automated at least 95% of their transactions. This would have huge, and positive, effect on the productivity of the sector. Sustainability analysis and reporting could be introduced quickly due to the integrated foundations and trustworthy data, both automating and pinpointing areas of rapid decarbonisation in the sector. And adopting dedicated technologies will also create greater efficiency, strategic advantages and better customer service.

This is the UK waste and recycling sector that we are working towards at ISB Global. Our work with the CIWM has given us data that reveals the challenges, perceptions and ambitions in the market, and this helps us to see how we can start to provoke change.

When published, the report will give us insights into how to implement that change, collaborating across the sector – something that respondents have indicated they are keen to do.

ISB Global is driving change in the waste and recycling management sector, designed to make it a world leader in technology adoption and use. We want organisations to be efficient and sustainable across all their working practices, building towards a circular economy, which is where we all need to be if we want to secure a future for our planet – and our place on it.