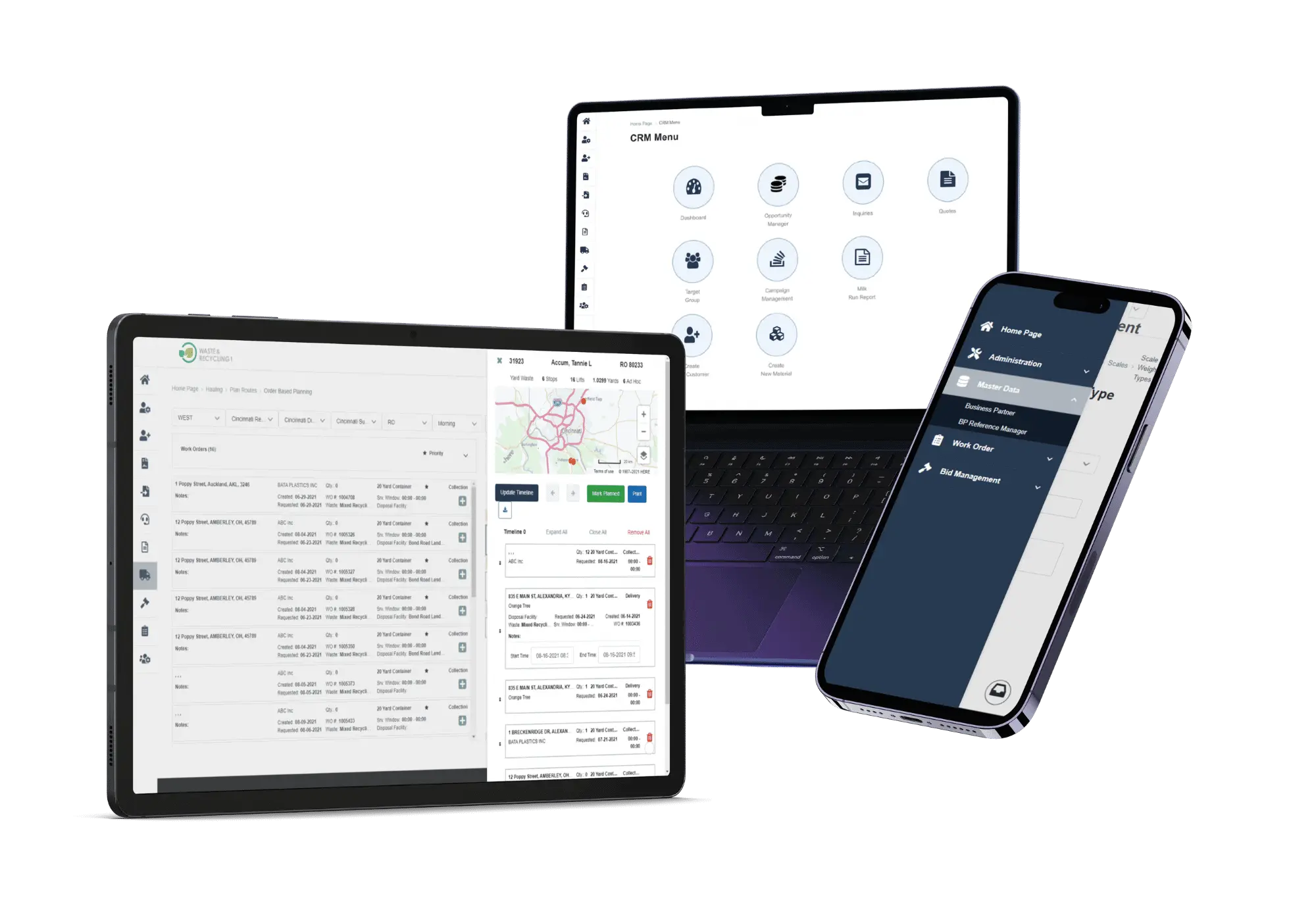

The Worlds Most Advanced

Waste Management Software

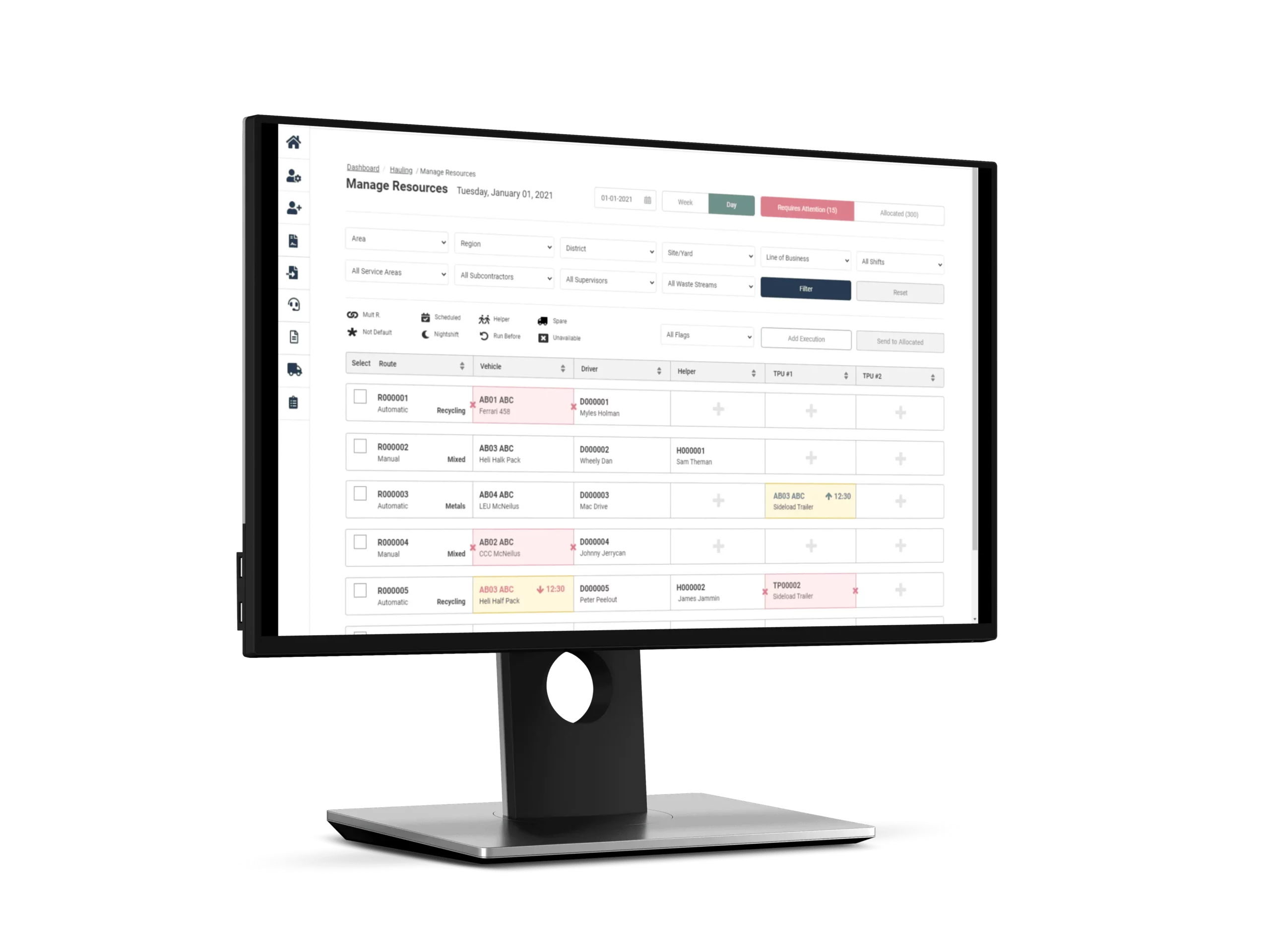

Software that integrates, automates, and simplifies to drive greater operational efficiency, productivity, and profitability for organisations that operate in the waste, recycling, clean energy, and environmental sector. Creating clean, efficient operations that contribute positively to the environment and circular economy.